Your Creative Journey on

Autopilot

Connect, Listen Live, Stream Together, and Get Paid

Why Swiftlane AI?

Swiftlane AI uses AI and Web3 to help artists grow, connect, and monetize. Gain insights, engage with fans, and focus on your craft – we handle the rest. Where creativity meets innovation.

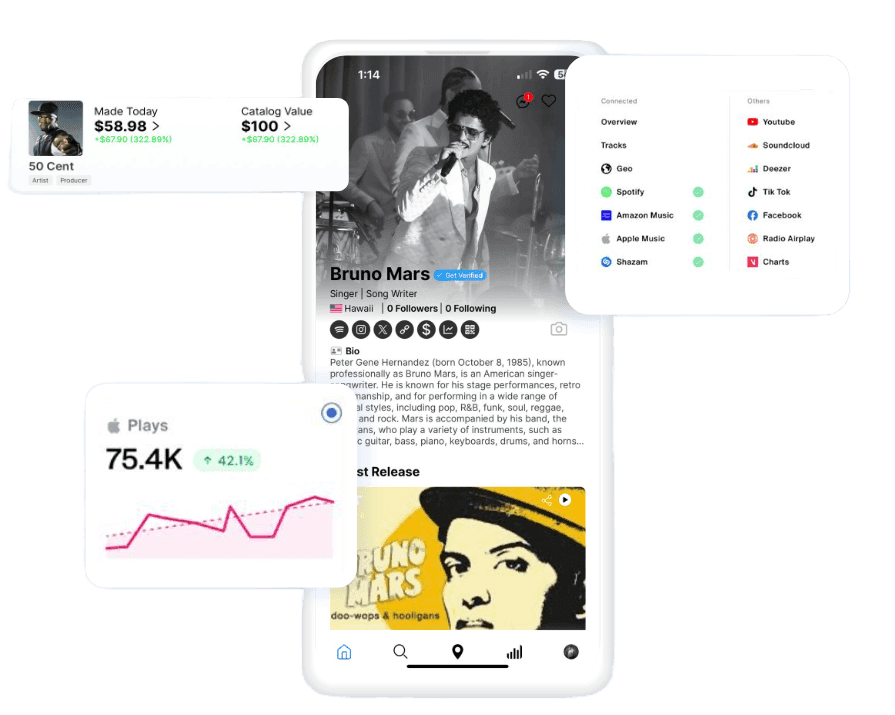

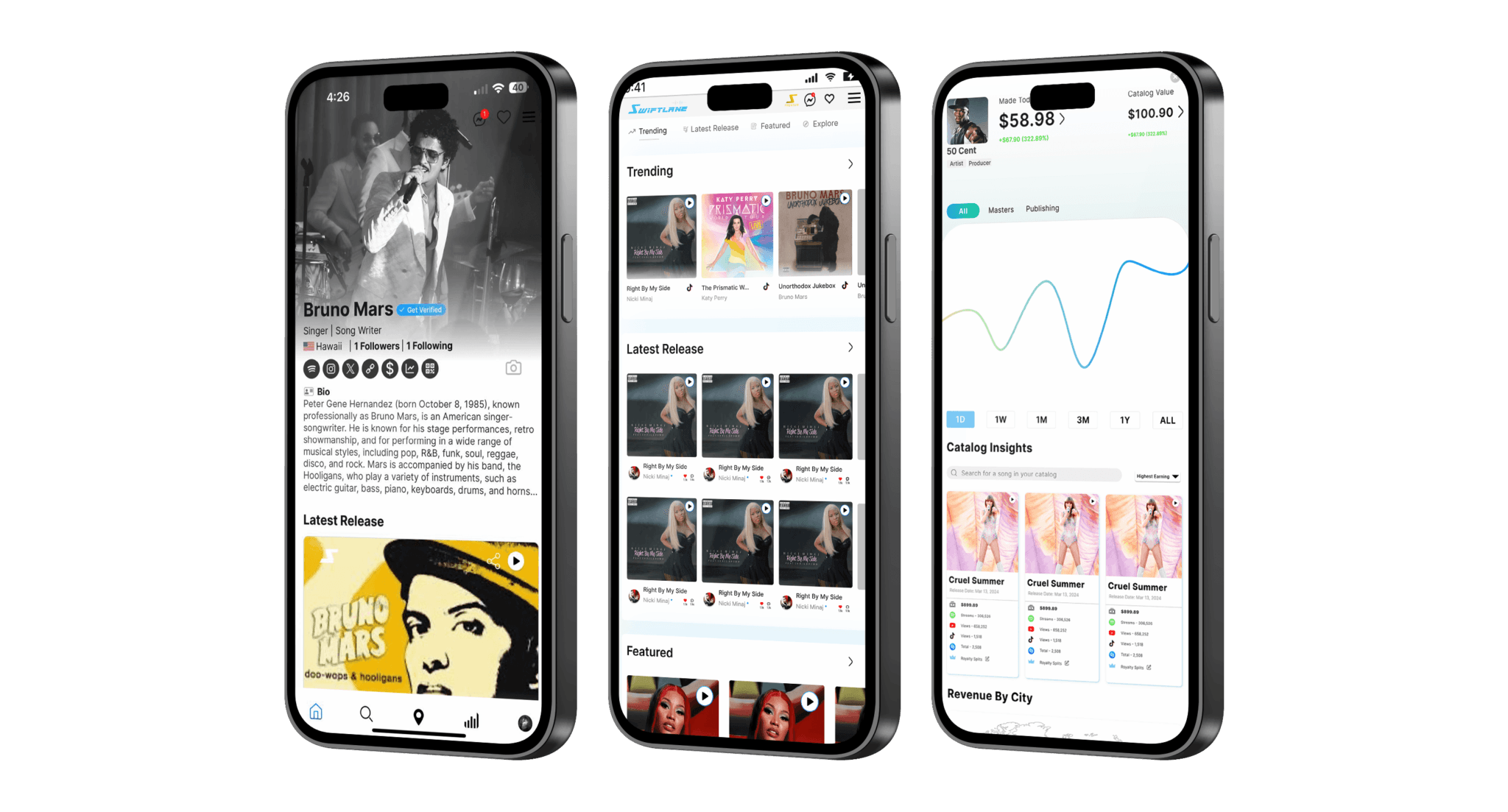

All–in–One Platform

Swiftlane AI combines royalty management, data analytics, and networking tools in a single platform, providing everything you need.

Drive Success

Gain valuable insights into your audience and connect with industry professionals, empowering you to make informed decisions.

What are you doing well?

Explore a world of music with our global catalog, featuring every genre and style. Discover trending hits by location or genre, and enjoy AI-powered recommendations tailored to your listening preferences.

OUR TEAM

Leadership Team

Abraham Ipe

Founder and CEO

Abraham Ipe brings extensive expertise in technology and music, managing billions in assets and leading the launch of transformative platforms like Comcast’s X1, scaling to 32 million users, and Real-Time Assist, reaching 50 million users. He has collaborated with top music labels to solve challenges in royalties, analytics, and networking, delivering innovative, scalable solutions that empower creatives and drive industry transformation.

Joe Myshko

Senior Technology Advisor

Joe Myshko, Senior Technology Advisor at Swiftlane AI, brings extensive expertise in network engineering, cybersecurity, and digital transformation. He has led major projects for Fortune 500 companies like Comcast, GE, and Vanguard, including global network design, application security, and scalable infrastructure development. Notably, Joe contributed to Comcast Xfinity’s Emmy-winning X1 platform. His deep technical knowledge ensures Swiftlane AI is secure, scalable, and innovative, empowering creatives in the digital space.

Chris Schwenk

Chief Marketing Officer

Chris Schwenk is a seasoned marketing strategist and CMO at Swiftlane AI, with a proven track record of driving brand growth and scaling businesses. With extensive experience in marketing, Chris specializes in crafting data-driven strategies, optimizing customer acquisition, and building impactful campaigns. His expertise helps bridge the gap between creativity and analytics, ensuring sustainable growth for Swiftlane AI’s innovative solutions in the creative industry.

Tune in. Turn it up.

Listen to your music, connect with other fans, and interact with your favorite artists.

XXX.

ılııl Kendrick Lamar

For The Artists

INSTANT ROYALTIES

Earn Swift Token for every second your music is streamed. Our micropayments technology enable instant settlement of streaming royalties. Earn upwards of 10-100X more than you can on Spotify or Apple Music.

SONG PROMOTION

Expand your fanbase by promoting your songs with Swift Token to verified first time listeners. Earn ROI from your new fans as they continue to stream and discover your music.

Collectible MINTING

Mint Music Collectibles (NFTs) with multiple songs, albums, art, video, royalties, and experiences; then sell them directly to your fans in our auction marketplace. Mint multi-tiered drops with different levels of unlockable perks and exclusive experiences.

For The FANS

PLAY TO EARN

Get paid to play songs. Earn Swift Token for listening to new promoted music. Discover new music based on your taste and get rewarded for finding your next favorite artist.

HIGH-RESOLUTION AUDIO

Stream music at the highest quality possible uploaded directly from artist as lossless uncompressed masters. Sort trending music by genre, location, instrument, and mood.

Unlockable EXPERIENCES

Buy digital collectibles from your favorite artists. Earn streaming royalties alongside artists as they gain popularity. Get exclusive access to experiences like meetups, VIP passes, and shows.

Contact Us for more information

Have questions? We're here to help! Reach out by email, phone, or our contact form, and we'll get back to you with all the details you need about Swiftlane AI.

Testimonials

User Reviews

Partners

Our Partners

Download the Swiftlane App

Send us a Message

Have questions or need more details? Reach out to us! Whether you're curious about our features, need technical support, or want to explore how Swiftlane AI can elevate your creative career, our team is ready to assist. Simply fill out the form below, and we'll respond promptly to ensure you get the information you need. We look forward to connecting with you!

Subscribe to Our Newsletter

Subscribe to our newsletter to be the first to know about new features, updates, and special offers.